Moody's Investors Service says Reliance Communications (RCOM) FY2015-16 results can be accommodated in its Ba3 corporate family rating and senior secured rating. The ratings outlook remains negative.

Moody's Investors Service says Reliance Communications (RCOM) FY2015-16 results can be accommodated in its Ba3 corporate family rating and senior secured rating. The ratings outlook remains negative.

RCOM's consolidated revenues for Q4 ended March 2016 were up 3.8% year-on-year (YoY) to around INR59 billion; revenues from India operations, - the largest contributor - were up 6.5% over the same period. In India, a decline of 8%YoY in voice revenue in 4Q 2016 was offset by a 27% increase on non-voice revenues.

RCOM's consolidated revenues for Q4 ended March 2016 were up 3.8% year-on-year (YoY) to around INR59 billion; revenues from India operations, - the largest contributor - were up 6.5% over the same period. In India, a decline of 8%YoY in voice revenue in 4Q 2016 was offset by a 27% increase on non-voice revenues.

At the same time, RCOM's global operations-accounting for approximately 19% of total revenues - reported a 4% decline in revenues in 4Q 2016.

For the full year ended Mar. 31, 2016 (FY2015-16), the company reported broadly stable revenues at Rs 221 billion, due mainly to its cancellation of licenses in five circles earlier this year.

''RCOM reported EBITDA of around Rs 74 billion, with its EBITDA margin decreasing by 0.4% over the previous year to 33.6%. The decline in EBITDA margin is in line with Moody's expectation, owing to increased contribution of data revenues and higher customer acquisition costs,'' says Nidhi Dhruv, a Moody's Vice President and Senior Analyst.

Moody's estimates RCOM's adjusted, consolidated debt/EBITDA was around 6.3x for the year ended Mar. 31, 2016, compared to 5.3x last year. This increase in leverage is notably due a INR38 billion increase in reported debt and the inclusion of INR33 billion deferred spectrum liabilities.

Upon the completion of the share swap transaction with Sistema Shyam Teleservices (SSTL unrated), RCOM will have adequate spectrum. However, should the company participate in the upcoming spectrum auctions, its leverage metrics will be further pressured.

RCOM also continues to have a strained liquidity profile, with the company remaining reliant on recurring covenant waivers due to its high leverage. There is also an ongoing need to refinance upcoming debt maturities.

RCOM has about USD 450 million in debt falling due in the quarter ending June 30, 2016, which includes a USD 350 million ECB facility at Reliance Infratel (unrated), which is guaranteed by RCOM and has a cross-default with other debt. Management is still in the process of renewing this facility with the banks and expects to complete the refinancing ahead of maturity.

Failure in obtaining final renewal approvals from the banks will lead to imminent ratings downgrade, which would be more than one notch.

"There have also been further delays in the RCOM's deleveraging plans. In December 2015, the company announced that it had entered into exclusive discussions with Aircel Limited (unrated) for a potential combination of businesses. This deal has yet to close and RCOM has extended the exclusivity period for its discussions with Aircel by another 30 days to 22 June 2016," adds Dhruv, also Moody's Lead Analyst for RCOM.

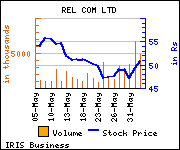

Shares of the company declined Rs 1.25, or 2.46%, to trade at Rs 49.50. The total volume of shares traded was 1,696,204 at the BSE (12.40 p.m., Friday).